I set up my accounting system with QuickBooks yesterday. May 20th was exactly one month after my business and brand launch. Of course, I’d had that task on my To-Do List since before 4/20, but it was one of those line items that kept getting circled and pushed to the next list. (That’s how I update my To-Do Lists. I scratch off completed items, circle the ones I’ve yet to finish and then add the circled tasks to the next list.) My best guess is that “Set up Accounting System” had been on no less than 10 paper lists and it lingered on my dry erase board for at least a fortnight before I completed it yesterday.

The reason that it wasn’t a top priority was because there haven’t been a plethora of transactions that needed to be recorded. I am receiving a little income from Stud Talk tickets and Redbubble sales, and I am having small expenditures for Zoom and Calendly. The lion’s share of my business “expenses” has been for nonprofit donations from the Stud Talk episodes as well as Seersucker Stud, LLC’s ceremonial launch donation to Montrose Grace Place here in Houston. Via Stud Talk, the company has now made donations to Mermaids (UK), The Trevor Project, The National Queer & Trans Therapists of Color Network and Out Youth (Austin). While the donations have been modest, I’m extremely proud that my new entity is demonstrating a legitimate commitment to philanthropic giving.

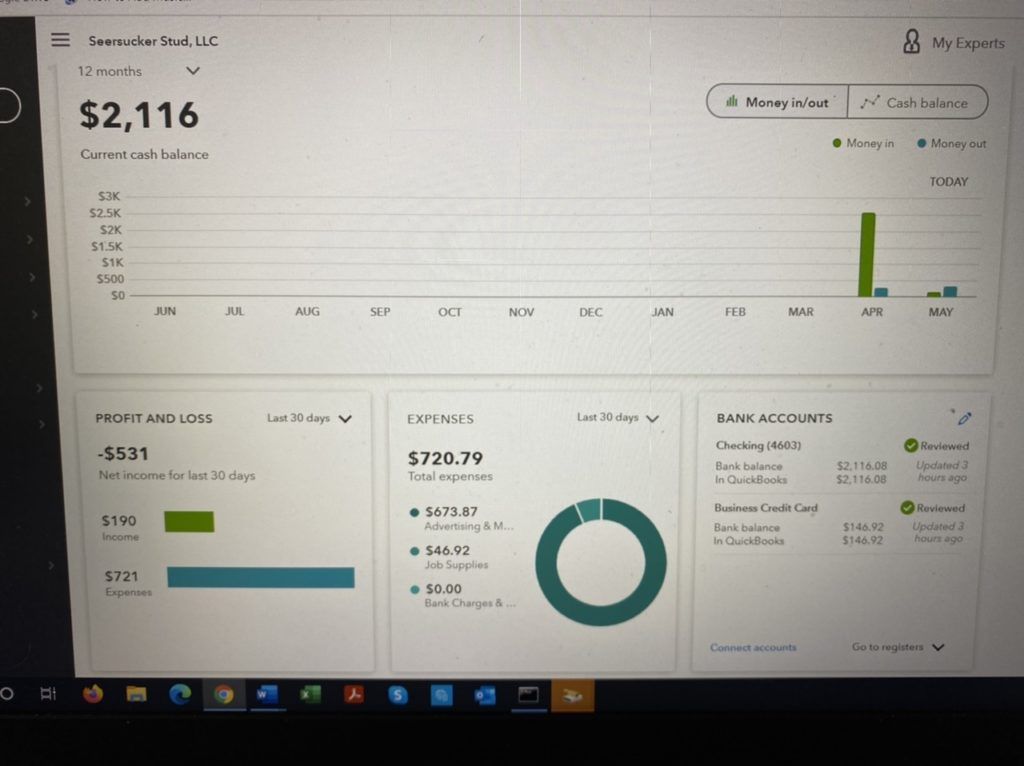

With my prior business, our CPA handled bookkeeping for the corporation in QuickBooks. I personally did all of the data entry for our charity in Aplos. Because Aplos is geared towards nonprofits, I elected QuickBooks for Seersucker Stud, LLC. Oh, so I forgot…yes, a second reason for the delay in setting up the accounting system was because I knew there would be a learning curve on the actual use of the software. But y’all. I’m so pleased and proud to report that after signing up, it only took me about two hours to enter all of the business details, integrate QuickBooks with both my business checking at PlainsCapital and my business credit card with Chase, enter and code all of the income and expense entries and then form the basic Balance Sheet and P&L reports. I literally could not wait to share those PDFs with my CPA. And while I was so elated with my efforts, there was minor frustration because my Balance Sheet was not matching up with the cash in my Operating Account. And with no other current assets present on the report, this meant there was an error, or, rather, that I had missed something. After taking a break, I figured it out. While I had entered all of the individual transactions and amounts properly, I did not note the “transfer” of funds from the checking account to the business credit card for the one payment I’ve made to it. Once that was reconciled – bam…everything matched up down to the penny.

I’ll admit to y’all that after one month, I’m not where I thought I would be. I’m absolutely having a blast and experiencing small, meaningful victories on a daily basis, but if I were to compare the life of my business to a marathon, I’d say that I was just inches past the start line. Things sure went off with a brilliant bang, but now reality has set in. The honeymoon is over. Choose your cliché…and that’s where I am.

When I founded the nonprofit in 2016, I got some superb advice from a close friend and role model that works in that sphere. She told me that even though I had no idea when and how fundraising would occur, the important thing was to have the systems in place and procedures clearly outlined for when the money did roll in. If that happened and things were not defined, it could lead to in-fighting with the Board of Directors as everyone would be wide-eyed, excited and enthusiastic about how to utilize the newly-received funds. I took that advice. From the onset and prior to receiving one dollar, we cemented the mechanisms for how income would be treated when donations arrived. We never had one problem.

So, the purpose of this blog, in addition to bragging on my proficiency of the very basic use of QuickBooks, is to let you know that while no real money has come into the business, I’m damn sure ready for the day when it does.

If you haven’t already, please subscribe to my newsletter below. You’ll receive a brief, weekly update on the content that I’ve pushed out across the various social media platforms during the prior week. And, be sure to enjoy my new Thirst Trap 101 episode on interacting with other pages that was released this morning.